Description

How it Works:

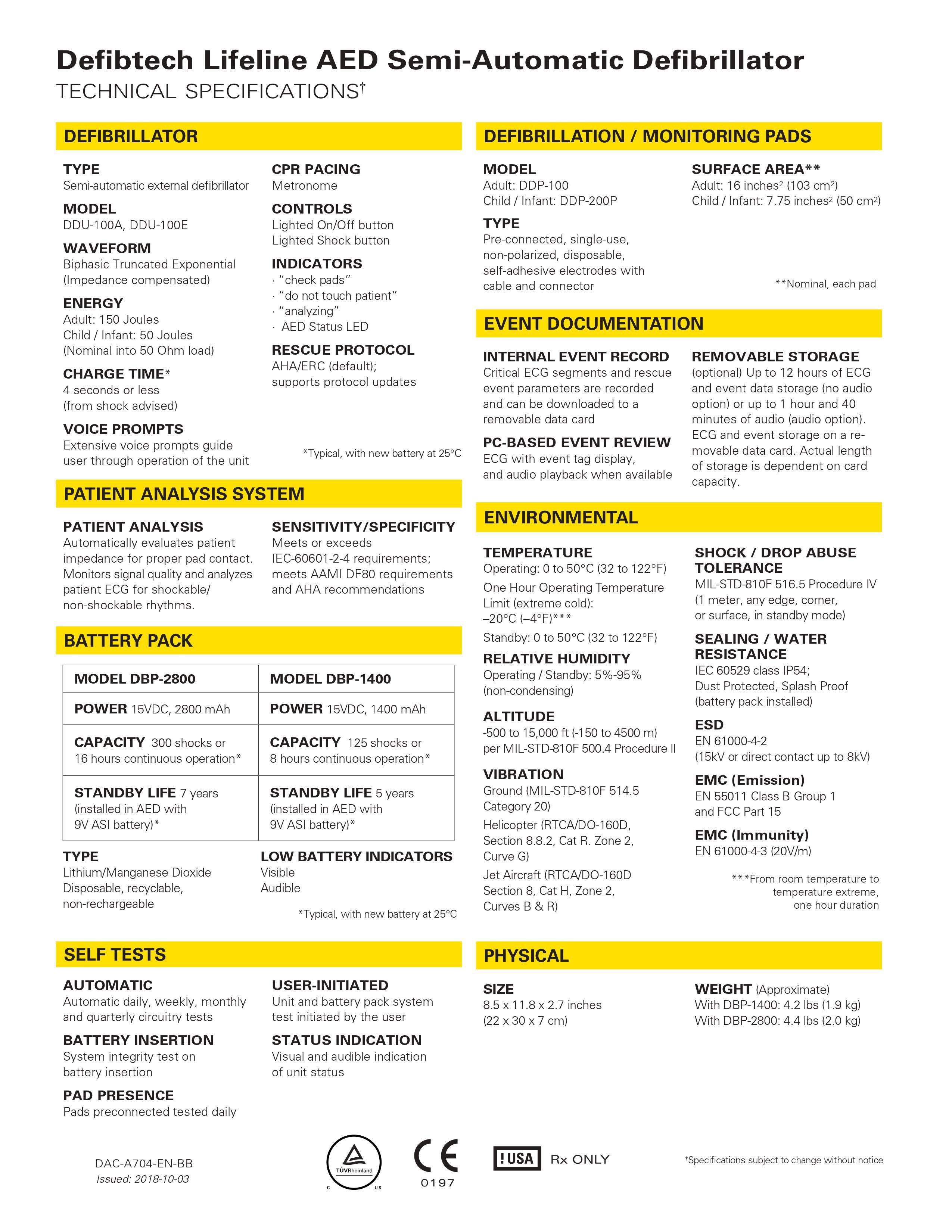

- You get a tax credit up to $500 per defibrillator.( If you order 10 then it will be $5,000 and so on)

- The credit equals the purchase price (e.g., pay $450, get a $450 credit; if you spend $600 you will receive a $500 credit which is the maximum PER UNIT.

- Claim the credit using NY State Form IT-250 or CT-250(for corporations) when filing your 2024 taxes. Learn more at: NY State Tax Credit Info.

- This is generally filed electronically by your accountant but this will be provided filled with the pertinent information. You will receive an IT-250 by default. and if you are a corporation just include that in the checkout notes

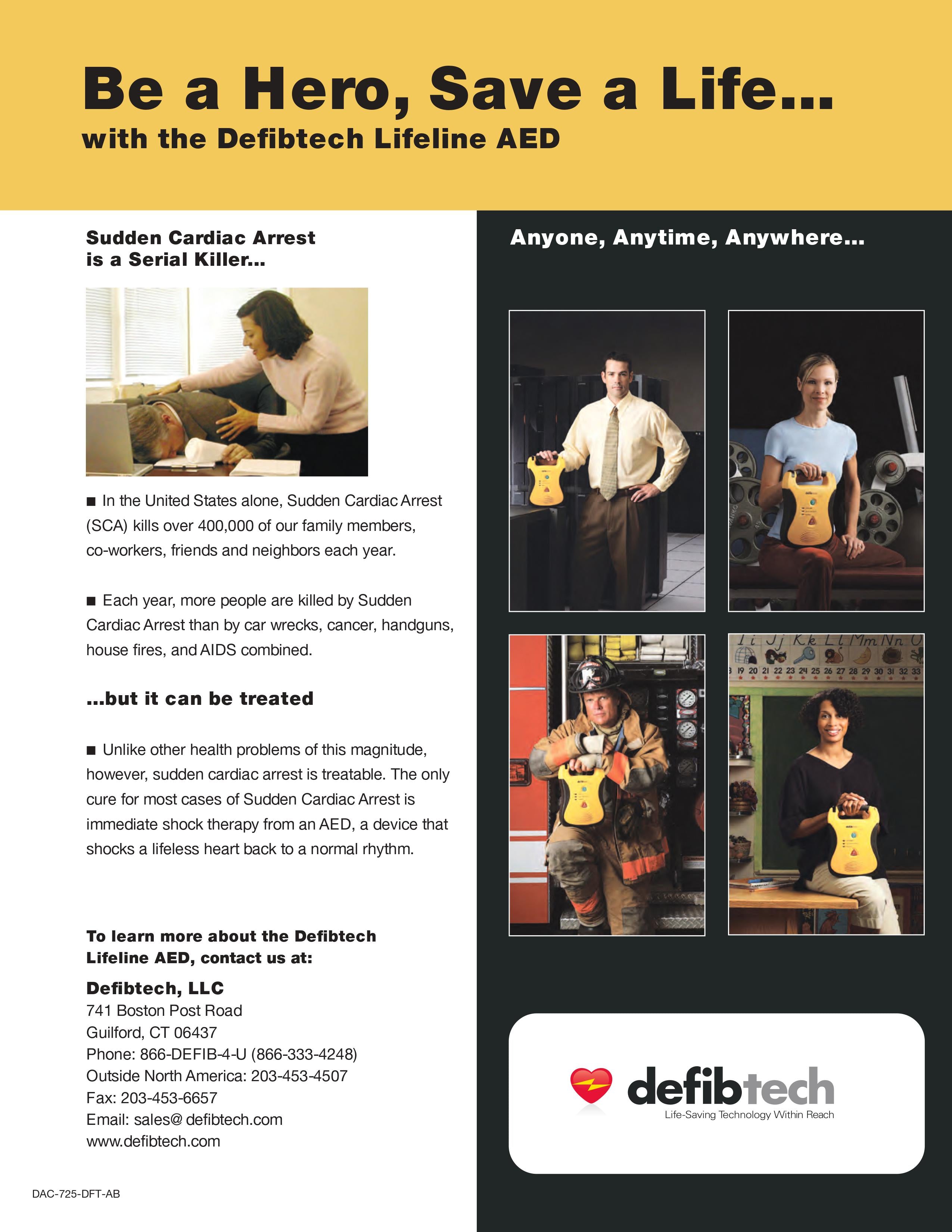

How to Purchase:

- Visit the purchase page and select how many you want to donate.

- The discount will apply automatically when you add to cart.

- Choose pickup in Jerusalem for general donations.

- If you have a specific recipient in Israel, ship to a specific address. Note: The order may need to be picked up from a central location in Jerusalem for final delivery.

Detai

- Shipping and distribution to Israel are covered unless shipping to a specific address, where additional coordination might be required.

- Learn more at: NY State Tax Credit Info.

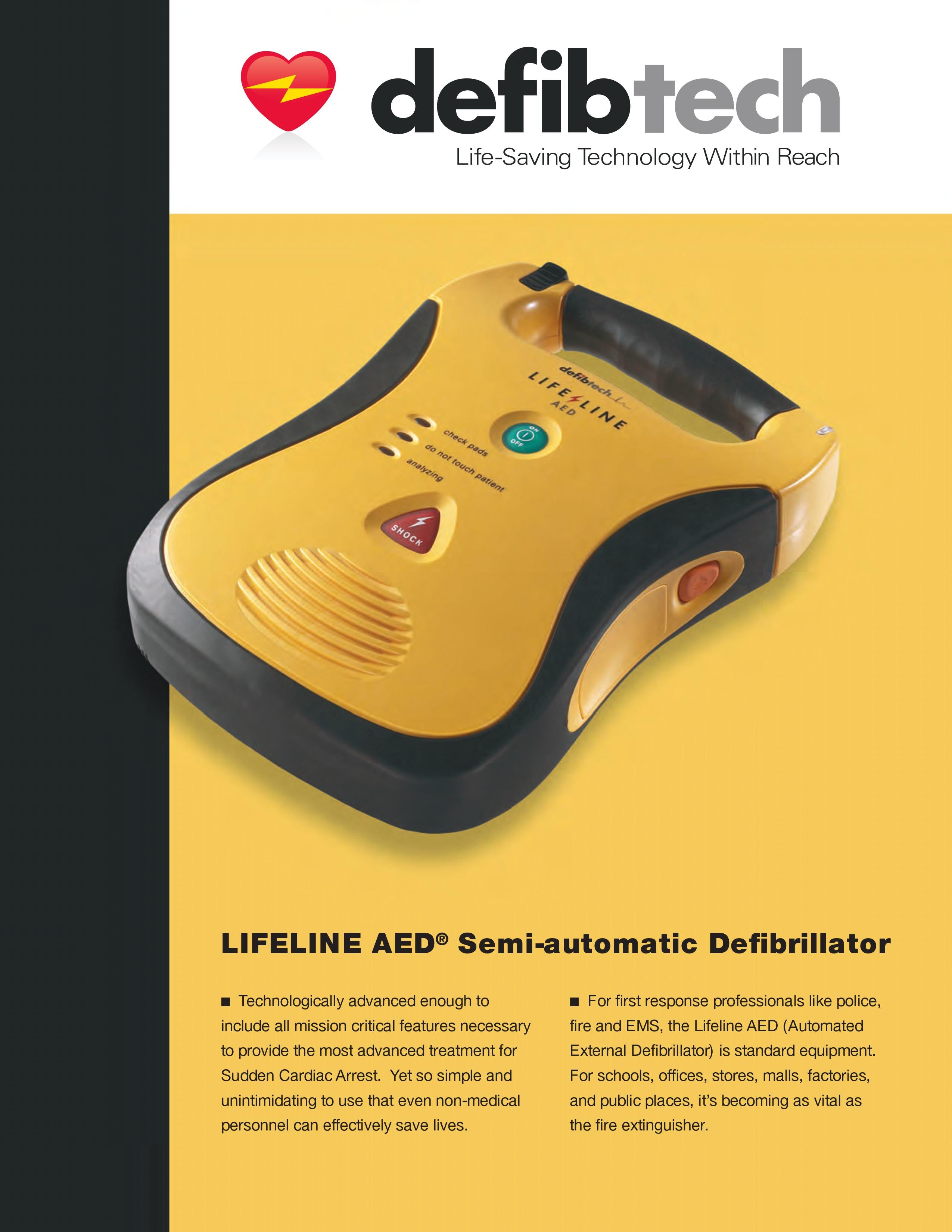

Make your purchase in 2024 and make a difference! Product Details

How it Works:

- You get a tax credit up to $500 per defibrillator.( If you order 10 then it will be $5,000 and so on)

- The credit equals the purchase price (e.g., pay $450, get a $450 credit; pay $600, credit is capped at $500).

- Claim the credit using NY State Form IT-250 or CT-250(for corporations) when filing your 2024 taxes. Learn more at: NY State Tax Credit Info.

- This is generally filed electronically by your accountant but this will be provided filled with the pertinent information. You will receive an IT-250 by default. and if you are a corporation just include that in the checkout notes

How to Purchase:

- Visit the purchase page and select how many you want to donate.

- The discount will apply automatically when you add to cart.

- Choose pickup in Jerusalem for general donations.

- If you have a specific recipient in Israel, ship to a specific address. Note: The order may need to be picked up from a central location in Jerusalem for final delivery.

Details:

- Shipping and distribution to Israel are covered unless shipping to a specific address, where additional coordination might be required.

- Learn more at: NY State Tax Credit Info.

Make your purchase in 2024 and make a difference!

You may also like